French Wealth Tax 2025 guide (Digital)

French Wealth Tax 2025 guide (Digital)

Couldn't load pickup availability

This guide is available as a digital file and can be accessed and downloaded from the links provided after checkout and via email. Please keep/save download links for future reference.

Updates, as relevant, will be provided during 2025 - please keep the digital link provided after purchase so you can access these. Printed versions are not available.

Published: 11/03/2025

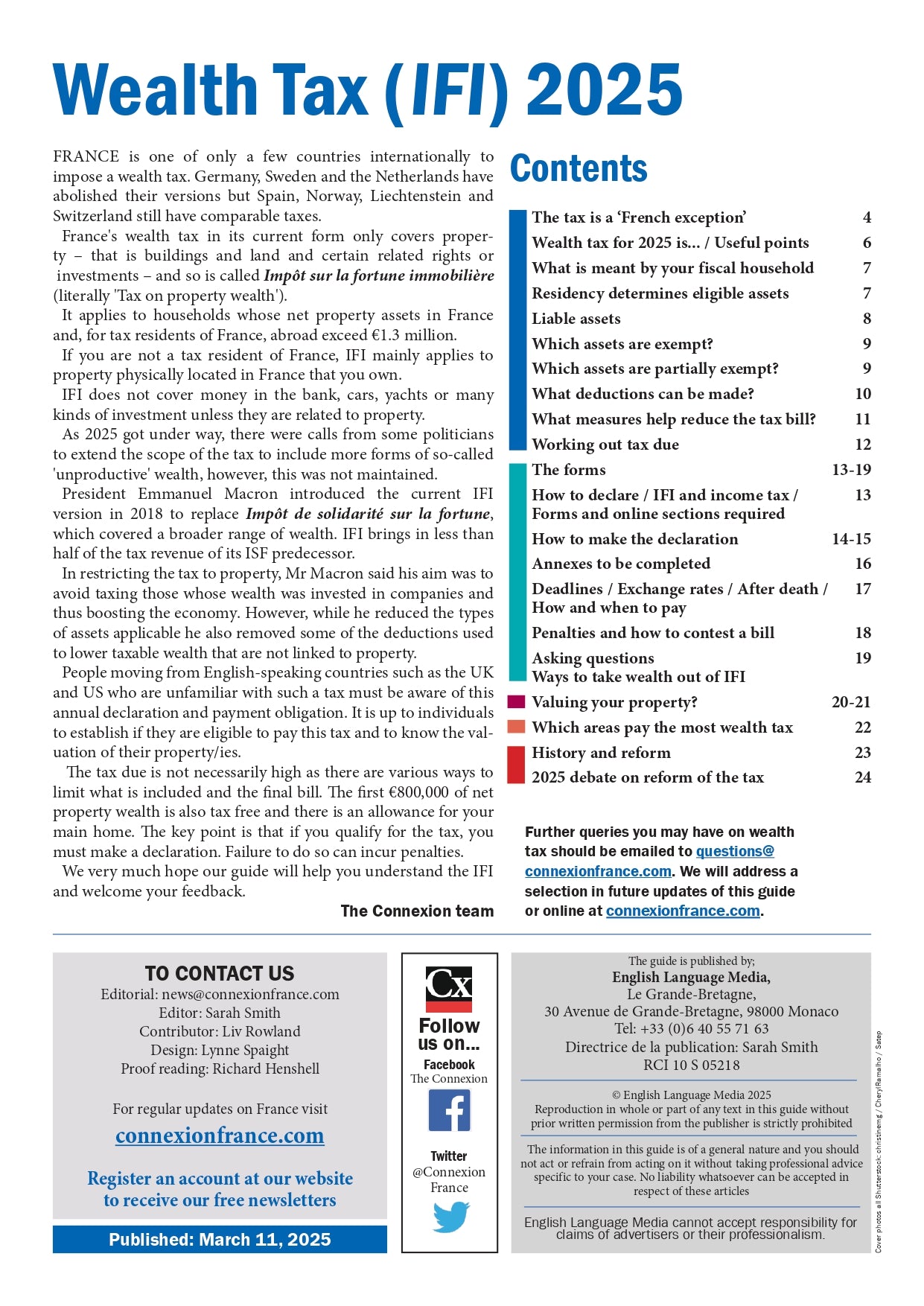

French Wealth Tax (Impôt sur la fortune immobilière- IFI) - Contents include:

- Wealth tax: what is it?

- Who does it affect?

- What is meant by your fiscal household

- Liable assets

- Assets that are exempt

- Assets that are partially exempt

- Deductions that can be made

- Measures that help reduce the tax bill

- Working out tax due

- How to declare / IFI and income tax

- Forms and online sections required

- How to make the declaration

- Annexes to be completed

- Deadlines for declaration

- Exchange rates to use

- How and when to pay

- Penalties and how to contest a bill

- Ways to take wealth out of IFI

- Ways your property can be valued

- Which departments pay the most wealth tax

- History and reform

- 2025 debate on making changes to the tax

IMPORTANT - PLEASE NOTE:

The information in this guide is of a general nature and is not advice which if needed can be sought by instructing a professional on the specifics of your situation.

All purchases are subject to our terms and conditions.

This guide is available as a digital file and can be accessed and downloaded from the links provided after checkout and via email. Please keep/save download links for future reference.

Share