Income Tax in France 2025 - for 2024 Income (Digital)

Income Tax in France 2025 - for 2024 Income (Digital)

Couldn't load pickup availability

What does the guide include?

- An annual French income declaration must be made by all residents and some non-residents. We explain the procedure and how this works alongside France's 'tax-at-source' system.

- It covers foreign bank accounts and many common scenarios foreigners face with their declaration/s within a system that is primarily aimed at the general French population.

- It looks at when you must declare and how and includes information on salaries, pensions, rents, shares, savings, investments and bank interest.

- the guide tackles common UK forms of investment such as ISAs but also contains significant general information pertinent to readers of other nationalities. There is some dedicated information aimed at Americans.

- Overview of the online declarations + step-by-step guide to declaring different types of income

The guide is published in digital / downloadable pdf format allowing us to make updates to it automatically as more information is released by the French tax authorities during 2025. The updates will be an addendum to your guide and an email will be sent alerting you to this. There is no additional charge for this.

Information needed to make your declaration is covered with a step-by-step guide to declaring the most common kinds of income*.

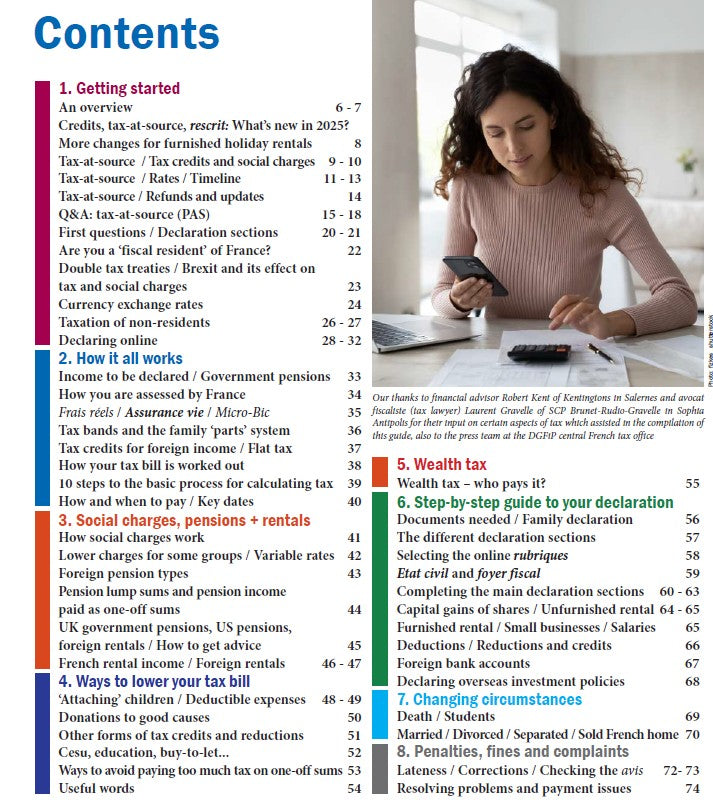

Contents include:

- Changes this year (2025), relating to declarations for 2024 income

- 2025 tax bands

- Exchange rates to use

- When do you become a tax resident of France?

- Income to be declared

- How the annual declaration works alongside France's 'at-source' taxation system

- How to amend your rate if circumstances change

- How your family situation can change the amount of tax you pay

- Examples of tax calculations

- Social charges: what these are, the rates and when they are applicable

- Tax credits: what are these given for?

- Declaring foreign bank accounts and investments schemes

- Non-residents and French rental income

- Ways to lower your tax bill

- S1s and tax / social charges

- What to do if you moved to France in 2024

- Who can benefit from lower social charges on pensions and investments?

- Clarification on changes to the taxation of gîtes / furnished holiday rentals

- Double tax treaties and Brexit

- Treatment of UK state pensions and UK / US government pensions

- Rental income from outside of France

- Online and paper form declaration options

- Step-by-step guide to filling in key declaration sections

- Self-employment

- Deadlines for payment and what if you cannot pay?

- Wealth tax: What this is and who has to pay

To come: Readers' Questions and Answers section

IMPORTANT - PLEASE NOTE:

* The guide includes significant information about the online process which is obligatory in almost all cases now. However, each person's online experience will be slightly different as the website tailors what is presented to them according to their choices. We do however provide step-by-step guidelines for the sections and boxes where income is declared. We continue to make reference to the printed tax forms, which many readers still find useful to complete before making an online declaration. In most cases box names and sections are the same whether on paper or online.

We illustrate the step-by-step chapter with extracts of the latest form layouts available. These are taken from last year’s forms as the tax authorities do not release any changed forms prior to the opening of the declaration period, so after publication of this guide.

We will add an addendum(s) to the guide detailing any relevant changes and alert you to this by email.

Please note that we are unable to update previous editions of a guide. Generally any updates will be made only within the same calendar year of publication.

The information in this guide is of a general nature, it is not advice which, if needed, can be sought by instructing a professional on the specifics of your case.

The Connexion is unable to enter into private correspondence on any matters relating to the completion of your income tax declaration/s, you would need to take appropriate advice for this.

All purchases are subject to our terms and conditions.

Share